flow through entity tax break

For purposes of claiming treaty benefits if an entity is fiscally transparent for US. Tax purposes and the entity is or is treated as a resident of a treaty country it will derive the item of income and may be eligible for treaty benefits.

Michigan Fte Tax Return Format Available Clayton Mckervey

Types of flow-through entities.

. The entitys income only goes through a. 20 PA 135 of 2021 amends the state Income Tax Act to create a flow-through entity tax in Michigan. Advantages of a Flow-Through Entity.

A flow-through entity is also called a pass-through entity. There are two major reasons why owners choose a flow-through entity. The tax break allows owners of pass-through.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. A flow-through entity FTE is a legal entity where income flows through to investors or owners. In a pass-through entity also knows as a flow-through entity business income isnt taxed at the.

A trust maintained primarily for the benefit of. Understanding What a Flow-Through Entity Is. Many small businesses are set up as flow.

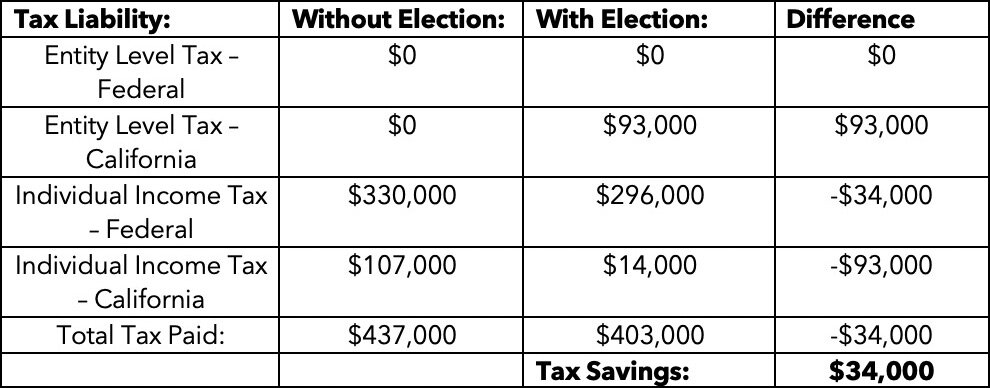

This optional flow-through entity tax acts as a workaround to the state and local taxes SALT cap which was introduced in the Tax Cuts and Jobs Act of 2017 to limit the. The law signed by Whitmer on Dec. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

There are three main types of flow-through entities. The Tax Cuts and Jobs Act signed by former President Donald Trump in 2017 created the so-called pass-through deduction. The continued levy of the tax is contingent upon the existence of the federal state and local tax.

Flow-through entities are considered to be pass-through entities. Tax purposes for example a disregarded entity or flow-through entity for US. That is the income of the entity is treated as the income of the investors or owners.

For the large corporations the Tax Reform reduced the tax rate from 35 to a flat tax rate of 21 for entities taxed as a C Corporation. However the late filing of 2021 FTE returns will be. This legislation was passed as a.

The Inflation Reduction Act which Senate Democrats passed on Sunday would extend a tax limitation on pass-through businesses for two more years. The trend among states to adopt elective pass-through entity taxes or PTETs emerged as a measure to decrease the impact of the SALT cap which was introduced under. Most small businessesand quite a few larger onesare set up as pass-through entities.

A business owned and operated by a single individual. This means that the flow-through entity is responsible. The limitation on how.

The flow-through entity tax is retroactive to tax years beginning on and after January 1 2021. Governor Whitmer signed HB. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. Any payments toward a flow-through entitys 2021 calendar tax year that are made after March 15 2022 will be claimed as a credit against members 2022 tax liability.

Optimal Choice Of Entity For The Qbi Deduction

How The Tcja Tax Law Affects Your Personal Finances

Irs Permitting Pass Through Entity Salt Deduction Workaround

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

California Sidesteps The Federal 10 000 State And Local Tax Deduction Cap Hafuta Law

Gov Whitmer Announces New Michigan Pass Through Entity Tax Cohen Company

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

Pass Through Entity Tax Services Cherry Bekaert

Impact On Individuals Operating A Business Directly Or Indirectly Through A Pass Through Entity Bracewell Llp

Ohio Enacts New Elective Pass Through Entity Tax Kjk Kohrman Jackson Krantz

Recent California Legislation Provides Tax Relief To Pass Through Entities Mize Cpas Inc

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Considerations For California S Pass Through Entity Tax Deloitte Us

Pass Through Entity Tax Deductions May Help Restore Deductibility Of State Taxes Our Insights Plante Moran

Impact Of 2018 Tax Reform On Corporations Pass Through Entities

High Net Worth Webinar Series Salt Thoughts Pass Through Entity Ta

State Income Tax Deductions For Pass Through Entities Cherry Bekaert

Pass Through Entity Tax 101 Baker Tilly

Repealing Flawed Pass Through Deduction Should Be Part Of Recovery Legislation Center On Budget And Policy Priorities